Key Market Insights

- Presently, around 350 players claim to have the necessary capabilities to offer several lab automation systems, catering to the needs of various end-users within the healthcare industry

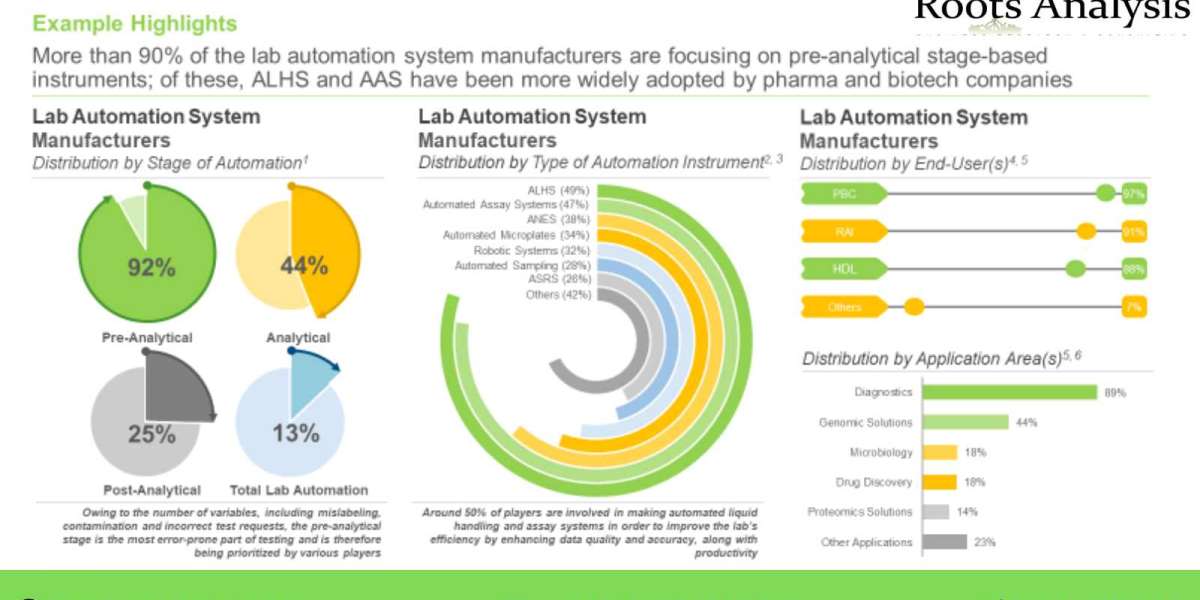

- More than 90% of the lab automation system manufacturers are focusing on pre-analytical stage-based instruments; of these, automated liquid handling systems and automated analysis systems have been more widely adopted by pharma and biotech companies

- In pursuit of gaining a competitive edge, companies are actively enhancing their existing capabilities to enhance their respective product portfolios and drive compliance to evolving industry benchmarks

- The partnership activity has increased at a CAGR of around 25%; in fact, the maximum deals related to lab automation have been inked in the last three years

- More than 6,200 patents related to lab automation have been filed / granted recently, highlighting the growing interest in scalable and configurable lab automation systems

- Majority of the lab automation software providers are headquartered in North America; more than 55% of the market is captured by small players

- The increasing adoption of lab automation in the healthcare industry is anticipated to create profitable business opportunities for lab automation software providers

- The lab automation market is estimated to grow at an annualized rate of ~15%; the opportunity is likely to be well distributed across various types of instruments, geographical regions, stages of automation and end-users

Table of Contents

- PREFACE

1.1. Introduction

1.2. Key Market Insights

1.3. Scope of the Report

1.4. Research Methodology

1.5. Frequently Asked Questions

1.6. Chapter Outlines

EXECUTIVE SUMMARY

INTRODUCTION

3.1. Overview of Lab Automation

3.2. Historical Evolution of Lab Automation

3.3. Stages of Lab Automation

3.4. Process of Lab Automation

3.5. Advantages of Lab Automation Over Manual Handling

3.6. Challenges associated with Lab Automation

3.7. Future Perspectives

- MARKET LANDSCAPE

4.1. Lab Automation System Manufacturers: Overall Market Landscape

- COMPANY COMPETITIVENESS ANALYSIS

5.1. Assumptions and Key Parameters

5.2 Methodology

5.3. Competitiveness Analysis: Very Small Companies based in North America (Peer Group I)

5.4. Competitiveness Analysis: Small Companies based in North America (Peer Group II)

5.5 Competitiveness Analysis: Mid-sized Players based in North America (Peer Group III)

5.5. Competitiveness Analysis: Large Companies based in North America (Peer Group IV)

5.6. Competitiveness Analysis: Very Large Companies based in North America (Peer Group V)

5.7 Competitiveness Analysis: Very Small Companies based in Europe (Peer Group VI)

5.8 Competitiveness Analysis: Small Companies based in Europe (Peer Group VII)

5.9. Competitiveness Analysis: Mid-sized Companies based in Europe (Peer Group VII)

5.10. Competitiveness Analysis: Large Companies based in Europe (Peer Group IX)

5.11. Competitiveness Analysis: Very Large Companies based in Europe (Peer Group X)

5.12. Competitiveness Analysis: Very Small Companies based in Asia-Pacific and Rest of the World (Peer Group XI)

5.13. Competitiveness Analysis: Small Companies based in Asia-Pacific and Rest of the World (Peer Group XII)

5.14. Competitiveness Analysis: Mid-sized Companies based in Asia-Pacific and Rest of the World (Peer Group XIII)

5.15. Competitiveness Analysis: Large Companies based in Asia-Pacific and Rest of the World (Peer Group XIV)

5.16. Competitiveness Analysis: Very Large Companies based in Asia-Pacific and Rest of the World (Peer Group XV)

- COMPANY PROFILES

6.1. Abbott

6.1.1. Company Overview

6.1.2. Financial Information

6.1.3. Lab Automation Product Portfolio

6.1.4. Recent Developments and Future Outlook

6.2. Anton Paar

6.3. BD

6.4. Beckman Coulter

6.5. ERWEKA

6.6. Leuze

6.7. Ortho Clinical Diagnostics

6.8. Pall Corporation

6.9. PerkinElmer

6.10. Roche Diagnostics

6.11. Siemens Healthineers

6.12. SYSTAG

- PARTENRSHIPS AND COLLABORATIONS

7.1. Partnership Models

7.2. Lab Automation: List of Partnerships and Collaborations

- PATENT ANALYSIS

8.1. Methodology and Key Parameters

8.2. Lab Automation: List of Patents

8.3. Analysis by Patent Publication Year

8.4. Analysis by Publication Year and Type of Patent

8.5. Analysis by Application Year

8.6. Analysis by Patent Jurisdiction

8.7. Analysis by CPC Symbols

8.8. Analysis by Type of Applicant

8.9. Word Cloud: Emerging Focus Areas

8.10. Analysis by Patent Age

8.11. Leading Industry Players: Analysis by Number of Patents

8.12. Leading Non-Industry Players: Analysis by Number of Patents

8.13. Leading Individual Assignees: Analysis by Number of Patents

8.14. Patent Benchmarking: Analysis of Leading Industry Players by Patent Characterization (CPC Symbols)

8.15. Patent Valuation: Methodology and Key Parameters

- MARKET FORECAST AND OPPORTUNITY ANALYSIS

9.1. Methodology and Key Assumptions

9.2. Global Lab Automation Market, 2023-2035

- CASE STUDY: LAB AUTOMATION SOFTWARE

10.1. Lab Automation Software Providers: Overall Market Landscape

- EXECUTIVE INSIGHTS

11.1. Chapter Overview

11.2. Africa Medical Supplies Platform

11.3. A.S.T. Biomedical

11.4. Berthold Technologi

11.5. Efevre Tech

11.6. HSE

11.7. Inheco

11.8. LabWare

11.9. SciRobotics

- APPENDIX 1: TABULATED DATA

- APPENDIX 2: LIST OF COMPANIES AND ORGANIZATIONS

To view more details on this report, click on the link

https://www.rootsanalysis.com/reports/lab-automation-market.html

News article

Non-viral Transfection Reagents and Systems Market

Learn from experts: do you know about these emerging industry trends?

Antiviral Drugs Development: Are we Prepared for the Next Viral Pandemic?

Exploring How Artificial Intelligence Is Transforming Digital Pathology

Learn from our recently published whitepaper: -

Next Generation Biomanufacturing – The Upcoming Era of Digital Transformation

About Roots Analysis

Roots Analysis is a global leader in the pharma / biotech market research. Having worked with over 750 clients worldwide, including Fortune 500 companies, start-ups, academia, venture capitalists and strategic investors for more than a decade, we offer a highly analytical / data-driven perspective to a network of over 450,000 senior industry stakeholders looking for credible market insights.

Learn more about Roots Analysis consulting services:

Roots Analysis Consulting - the preferred research partner for global firms

Contact:

Ben Johnson

+1 (415) 800 3415