Many medical device companies outsource analytical testing tasks to reduce costs, hasten the entry of new products into the industry, and eliminate commercial risks. Because these procedures result in significant cost increases, original equipment manufacturers of medical devices swiftly turn to outsource as one of the best ways to reduce costs.

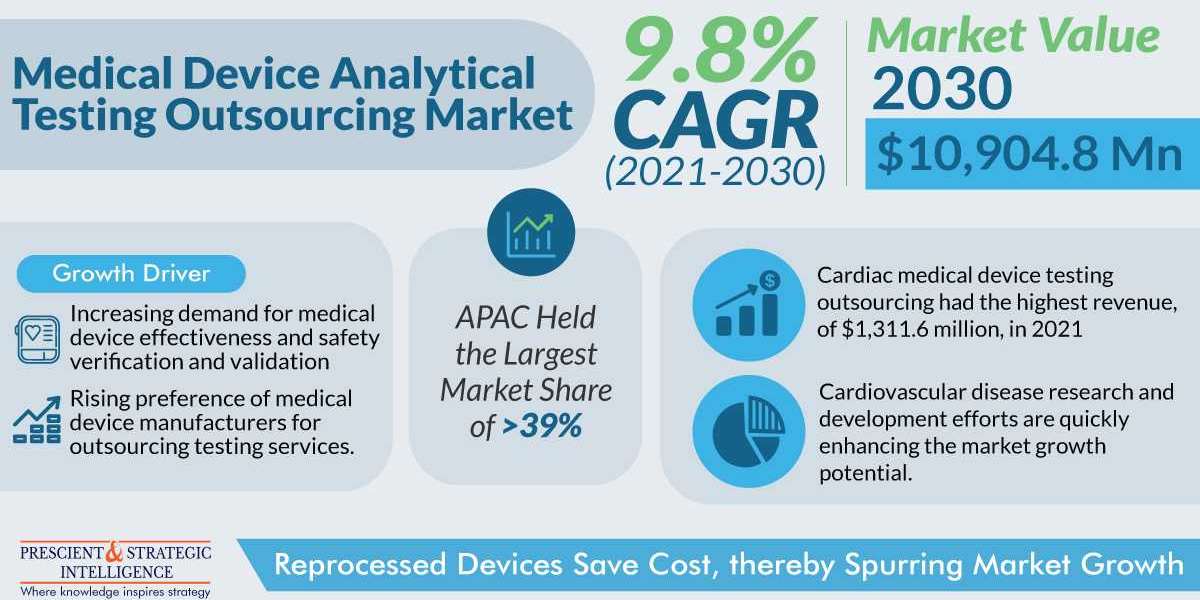

The medical device analytical testing outsourcing market is set to increase to $10,904.8 million by 2030. This is ascribed to an increase in small-scale medical equipment manufacturers, the need for validation and verification of medical device efficacy and safety, and the implementation of stringent governmental regulations.

Medical device manufacturers are engaging consultants to assist them in understanding the paperwork and legal requirements for pre-market approval.

Quality certification for medical equipment is crucial since the advent of contemporary technologies, such as surgical robots, surgical microscopes, and many others, have decreased the direct engagement of humans in surgical operations.

The demand for minimally invasive procedures propels the widely-used medical device analytical testing outsourcing market.

Research and development initiatives into cardiovascular disease are rapidly increasing the market's potential for growth. For instance, the mCRM modular treatment device is the subject of Boston Scientific Corporation's MODULAR ATP clinical research, which intends to examine its functionality, safety, and efficacy.

The Category that Generates the Most Revenue Is Cardiology

Cardiology is the practice and science of treating blood and heart vascular situations. Due to the rising frequency of heart problems, there is a greater need for cardiovascular devices, which is why outsourcing is expanding.

Over 17 million people die each year from cardiovascular diseases, and this figure is expected to increase to 23.6 million by 2030, according to a source.

Furthermore, CVDs are quite complex, requiring the safest and most user-friendly diagnostic and therapeutic tools imaginable. In response to this and a rise in the number of patients, medical device companies are collaborating with CDMOs, increasing manufacturing, and outsourcing the analytical testing process.

Reprocessed Devices Save Cost

Reprocessing is done to save costs; however, it frequently puts patient safety in danger. However, the FDA-approved systematic research proposes reducing long-term healthcare costs and providing financial benefits in developed nations, especially those in the U.S. and European countries.

Reprocessing includes

• cleaning up any apparent debris,

• completely sterilizing the medical item, and

• packing and labeling it.

Therefore, the repressor is ultimately liable for any negative impact the reprocessed device may have on patients.

Why is APAC Dominating Region?

Due to government initiatives to strengthen the healthcare infrastructure, the APAC region now controls most of the market, accounting for over 39% of total revenue in past. Furthermore, the expansion of the industry is expected to be aided by changes in the economies of China and India.

Additionally, there is a great demand for affordable treatment choices because of the area's massive population and low per capita income. Multinational firms are also ready to make investments in these developing nations.

The Chinese government's initiatives to streamline the regulatory framework for foreign investors, speed up the approval of cutting-edge medical equipment, and loosen the procurement restrictions on specific equipment have also helped the country experience the highest market growth in the region—nearly double digits.